1041 Schedule D Tax Worksheet

Line 4Tax on the ESBT Portion of the Trust. Information about Schedule D and its separate instructions is at.

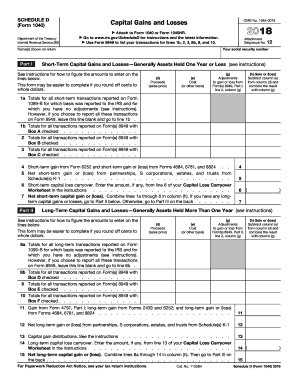

Irs Form 1041 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Templateroller

Who Uses Form 1041 Schedule D.

1041 schedule d tax worksheet. You will recieve an email notification when the document has been completed by all parties. This document has been signed by all parties. You can download or print current or past-year PDFs of 1041 Schedule D directly from TaxFormFinder.

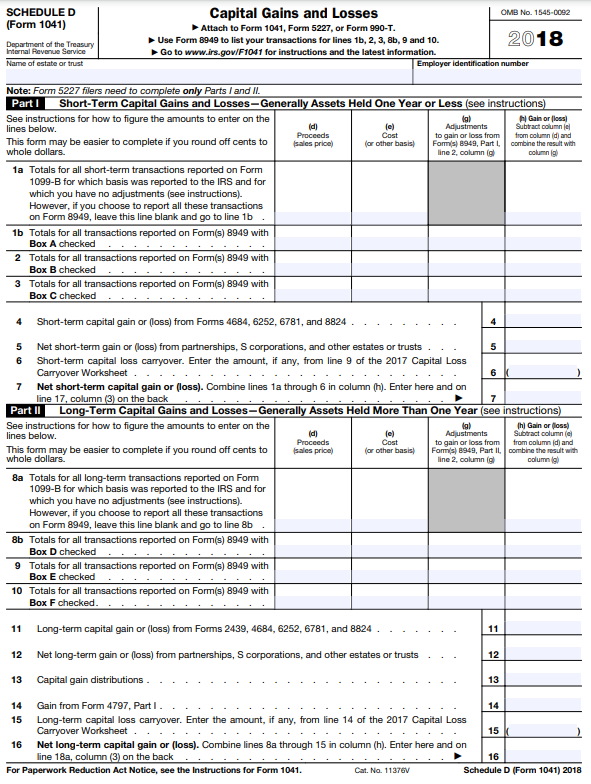

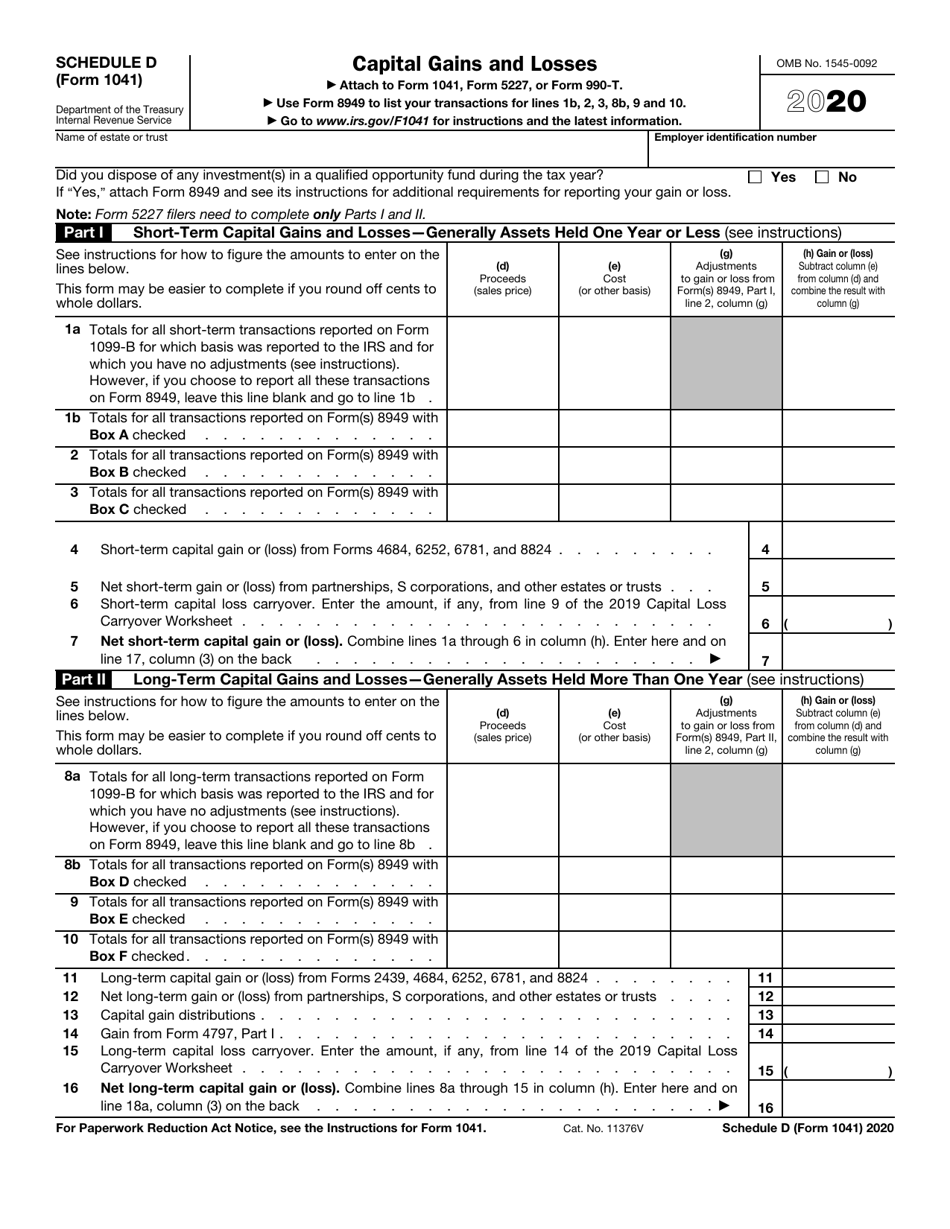

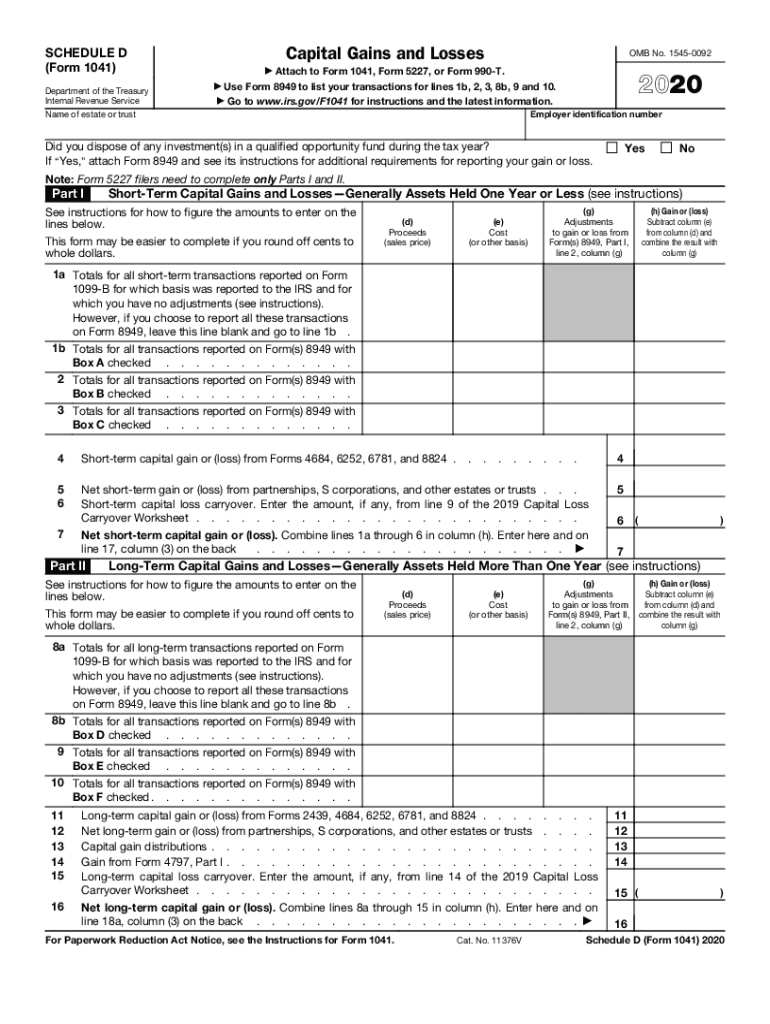

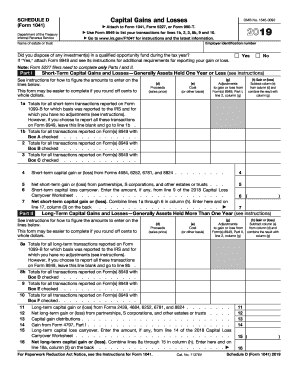

Complete Schedule D Tax Worksheet to calculate tax on all of the entitys taxable income. SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T. Discover learning games guided lessons and other interactive activities for children.

The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D Form 1041 filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18c column 2 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 18b column 2 of Schedule D. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. You have successfully completed this document.

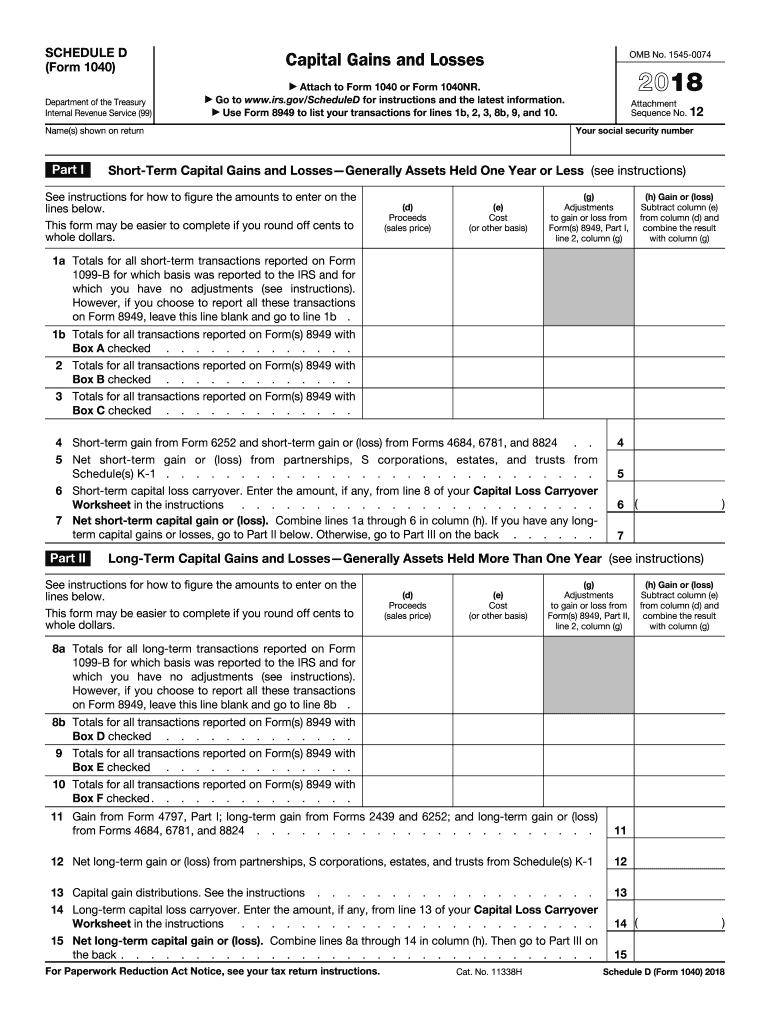

Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. IRS Form 1041 Schedule D is a supporting form for the US. Form 1041 schedule d.

If the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691c deduction was claimed you must reduce the amount on Form 1041 page 1 line 2b2 or Schedule D line 22 line 7 of the Schedule D Tax Worksheet if applicable by the portion of the section 691c deduction claimed on Form 1041 page 1 line 19 that is attributable to the estates or trusts. Use your indications to submit established track record areas. We last updated the Capital Gains and Losses in January 2021 so this is the latest version of 1041 Schedule D fully updated for tax year 2020.

You may also need to complete Form 8949 to list transactions reported on Schedule D. You can print other Federal tax forms here. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10.

Add your own info and speak to data. Form 1041 schedule D Capital Gains and Losses. Instructions for Schedule D Form 1041 - General Instructions for Introductory Material for Schedule D Form 1041 - Noticesection references are.

Use Form 1041 Schedule D to report gains or losses from capital assets associated with an estate or trust. An estate or trust uses Form 1041 Schedule D. Reporting Capital Gains for Trusts and Estates Griffin H.

Make sure that you enter correct details and numbers throughout suitable areas. Schedule D Form 1041 is used for reporting details of gain or loss from sales or exchanges of capital assets and to assist in the computation of alternative tax for certain cases in. Line 2aForeign Tax Credit.

Schedule D Tax Worksheet Keep for Your Records Complete this worksheet only if line 14b column 2 or line 14c column 2 of Schedule D is more than zero. 2020 tax rate schedule. Either line 18b col.

2 is more than zero or Both Form 1041 line 2b1 and Form 4952 line 4g are more than zero. Other parties need to complete fields in the document. Skip this part and complete the Schedule D Tax Worksheet in the instructions if.

This document is locked as it has been sent for signing. Form 1041 is what a fiduciary of an estate or trust must file by the filing deadline. You will recieve an email notification when the document has been completed by all parties.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error. Name of estate or trust.

Qualified Dividends Tax Worksheet. Form 1041 Schedule D. Schedule D Worksheets.

Make sure you are using the correct Schedule D as there is a schedule D for Form 1040 but they are not interchangeable. 2 or line 18c col. Resulting tax liability in entered on Form 1041 Schedule G Line 1a 16.

Line 2bGeneral Business Credit. Form 1041 Schedule D is a supplement to Form 1041. 2 is greater than zero.

Other parties need to complete fields in the document. You have successfully completed this document. On the site with all the document click on Begin immediately along with complete for the editor.

Completed 7 March 2020. For instructions and the latest information. How to complete any Schedule D-1 1041 form 2011-2021 online.

2 or line 18c col. Line 2cCredit for Prior Year Minimum Tax. This document has been signed by all parties.

SCHEDULE D Form 1041 Department of the Treasury Internal Revenue Service Capital Gains and Losses Attach to Form 1041 Form 5227 or Form 990-T. Discover learning games guided lessons and other interactive activities for children. Income Tax Return for Estates and Trusts.

DIFFERENCES IN INCOME TAX BASIS BETWEEN TRUSTS AND ESTATES. Do not use this worksheet to figure the estates or trusts tax if line 14a column 2 or line 15 column 2 of Schedule D or Form. Schedule D Form 1041 and Schedule D Tax Worksheet.

Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and Unrecaptured Section 1250. Skip this part and complete the Schedule D Fiscal Worksheet in the instructions if line 18b col. This document is locked as it has been sent for signing.

Irs Form 1041 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Templateroller

Form 1041 Schedule D Capital Gains And Losses

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download

Form 1041 Schedule D Capital Gains And Losses

2020 Form Irs 1041 Schedule D Fill Online Printable Fillable Blank Pdffiller

Question Based On A Through C Complete Chegg Com

Form 1041 Nr Us Income Tax Return For Foreign Estates Trusts 2007 Omb No Department Of The Treasury Internal Revenue Service A Type Of Entity See Ppt Download

Https Www Irs Gov Pub Irs Prior I1041sd 2018 Pdf

Fillable Form 1040 Schedule C 2019 In 2021 Irs Tax Forms Credit Card Statement Tax Forms

Fillable Form 1041 Tax Return Income Tax Income Tax Return

Schedule D 541 California Franchise Tax Board

Schedule D Fill Out And Sign Printable Pdf Template Signnow

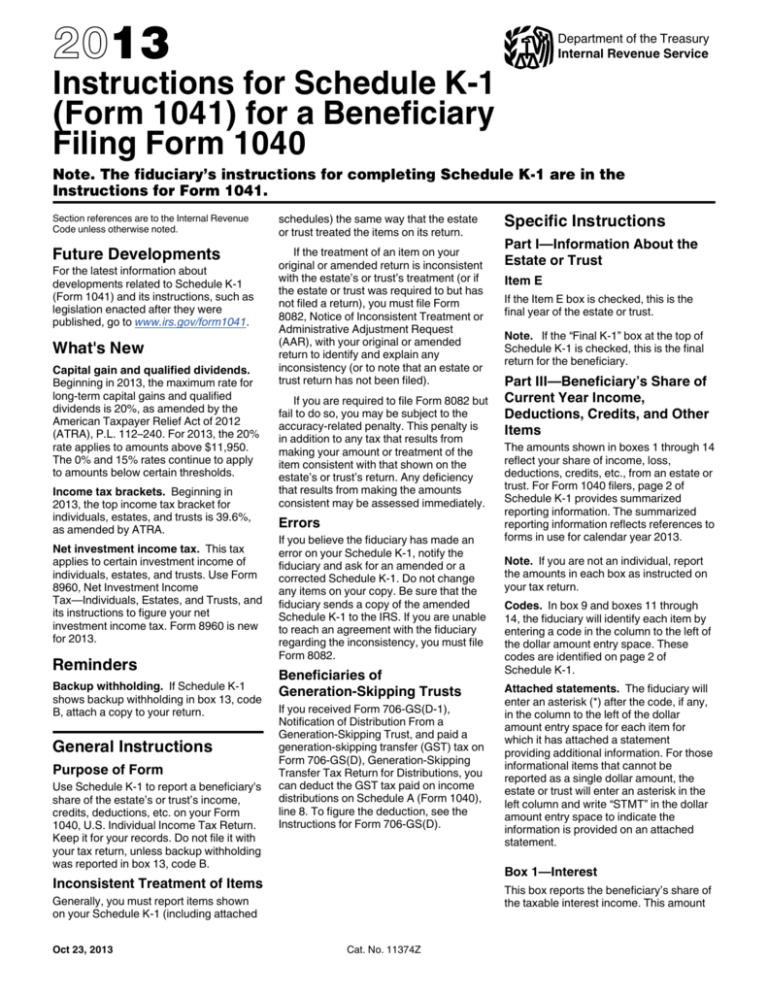

Instructions For Schedule K 1 Form 1041 For A Beneficiary Filing

Form 1041 Schedule D Capital Gains And Losses

Form Schedule D Fill Out And Sign Printable Pdf Template Signnow

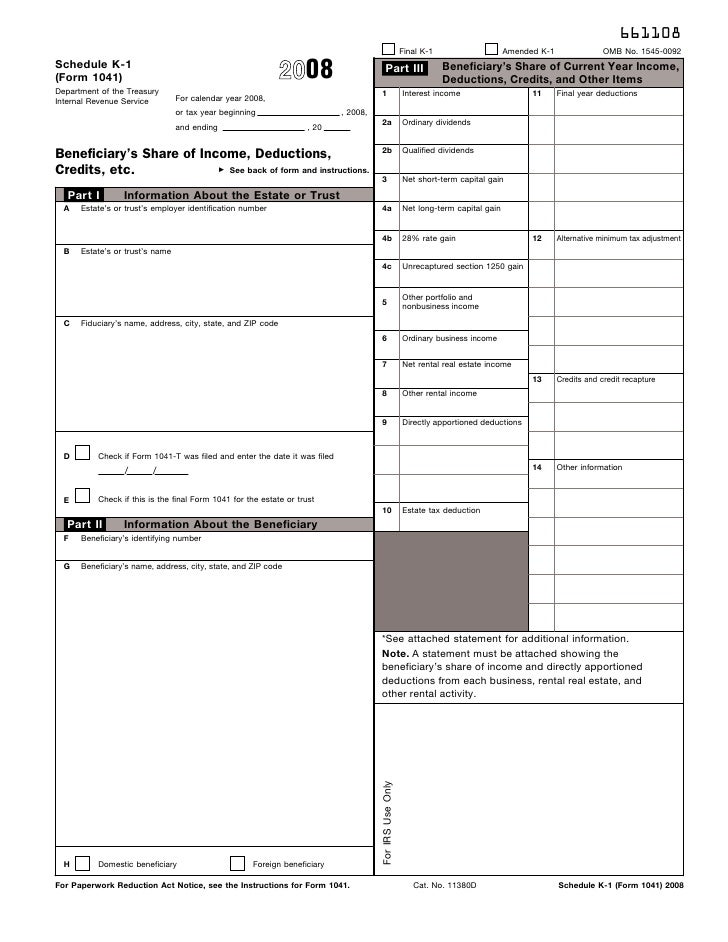

Form 104 Schedule K 1 Beneficiary S Share Of Income Deductions

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download

Schedule D Tax Worksheet 2014 Nidecmege

Form 1041 N U S Income Tax Return For Electing Alaska Native Settle